Are you a NDIS Support Coordinator or Participant?

If you are here, you’re likely a NDIS Support Coordinator or a Participant.

As you know, the NDIS provides funding to participants for supports and services aimed at increasing your (or your client’s) independence, inclusion, and social and economic participation.

Why Financial Literacy?

We believe that financial literacy is an important deciding factor for how confident, empowered and secure an individual feels. It is a huge outlier in feeling stable in life, and therefore one of the most important skills a person can build. Differently abled people can be more vulnerable and susceptible to financial stress, and having this foundational knowledge can only assist in building your Streetwise Money knowledge, and making better financial decisions.

Why Work on your Financial Literacy?

How are you meant to make the right decisions on education, loans, savings, credit cards, and so much more when you don’t understand the basic financial principles?

We are proud to provide our inclusive, interactive Financial Literacy course that gives everyone the opportunity and chance to contribute and survive in a money driven world without feeling overwhelmed and confused.

What you’ll learn

How to successfully save for that house deposit, car or holiday you’ve been dreaming about

You’ll get the money knowledge you need to set, manage and smash your financial goals - whatever they may be! More than that, you’ll have the confidence to make educated and informed choices to create financial freedom and live the life you’ve dreamed of!

How to master your spending habits and make your money work for you

Are your spending habits strangling your life goals? Take your money confidence to the next level by learning what cash flow is and how you can track where, when and what you spend your money on!

How to eliminate feelings of anxiety and overwhelm when it comes to taking control of your money

To set yourself up for success and reduce money-related stress, you need a budget! You’ll receive a downloadable budgeting spreadsheet to help you create positive spending habits and help you to achieve your goals of owning a home, embarking on the adventure of a lifetime or whatever else your heart desires!

How to hold yourself accountable for your spending and achieving financial freedom

Say goodbye to your Fear of F***ing Up with a better understanding of impulse control so you can decide when you should spend and when you should save to give yourself the ultimate financial freedom. We’ll even help you hold yourself accountable with our “gap tracker” tool!

Quick Facts

Price - $169.00

Presented - Online

Time - The course uses 3 hrs of your capacity building availability. But you can take as long as you want to complete it as well as the ability to go back through it in the future.

Course Level - Entry level. Basic computer and comprehension skills required.

Do you have the right plan/codes?

If you have Core Support or Capacity Building in your plan, you may be able to access our program. An example of appropriate codes are below.

01_134_0117_8_1 Self Management Capacity Building

15_035_0106_1_3 Assistance With Decision Making Daily Planning and Budgeting

15_037_0117_1_3 Individual Skill Development and Training including Public Transport Training

There may be other applicable Capacity Building item codes available, or already in your (your client’s) plan. Please discuss with your Plan or Finance Manager, or get in touch to discuss if needed. If these codes aren’t already in your current plan, please ensure you’ve added them to your plan prior to registering for the course.

Is this the right course for you?

This course is right for you if you plan to take more control of your money position and become more independent.

An example of how this course could work for you –

What the course includes

$169 AUD = 3hrs Capacity Building availability

Streetwise Money™ + Financial FOFU Course

Want to learn more about what’s included? Just click here

Access to 3-4 valuable online video modules

You will get access to our easy to follow online video modules on cash flow, budgeting, gap tracker and tax which you can do in your own time and at your own pace!

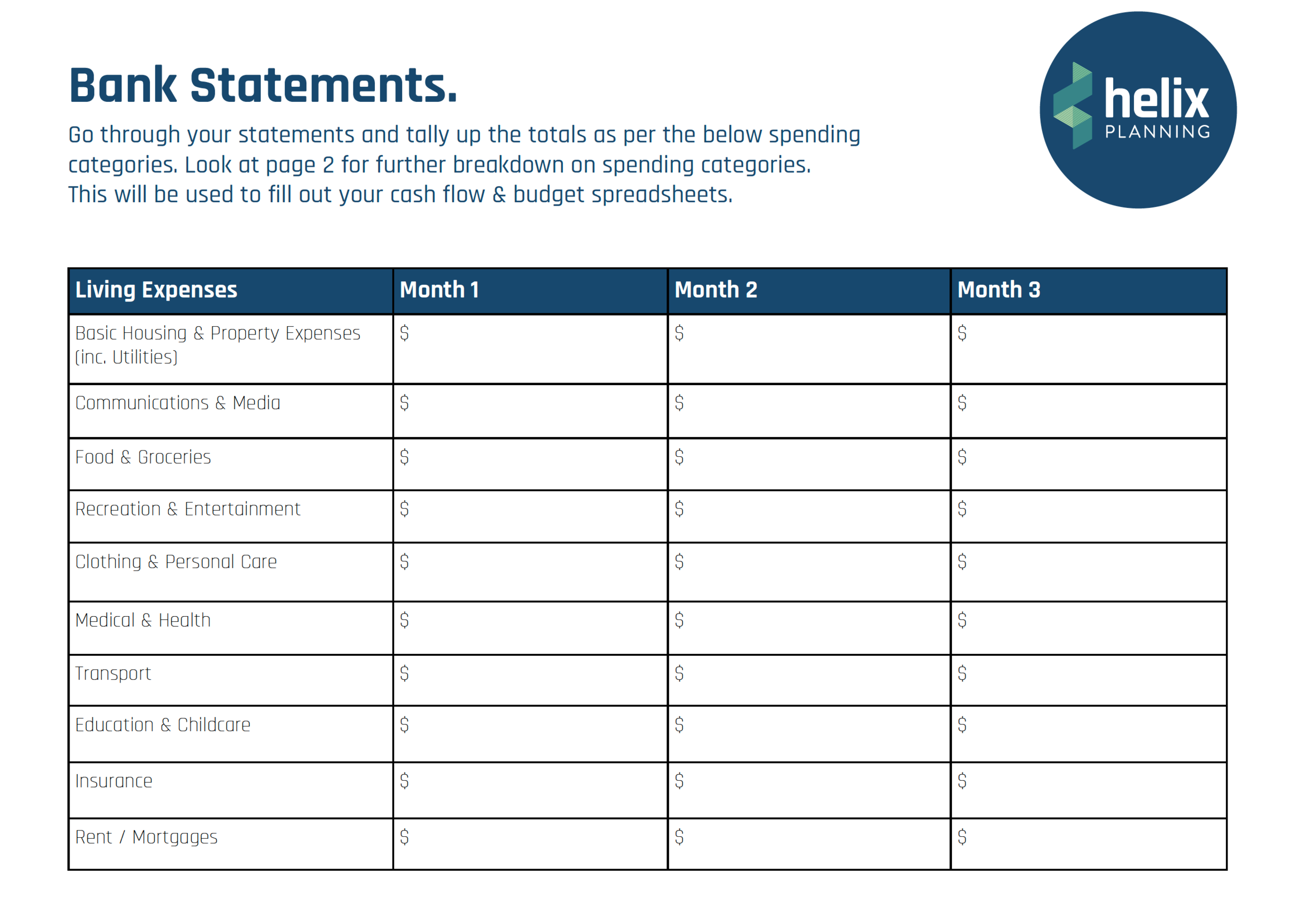

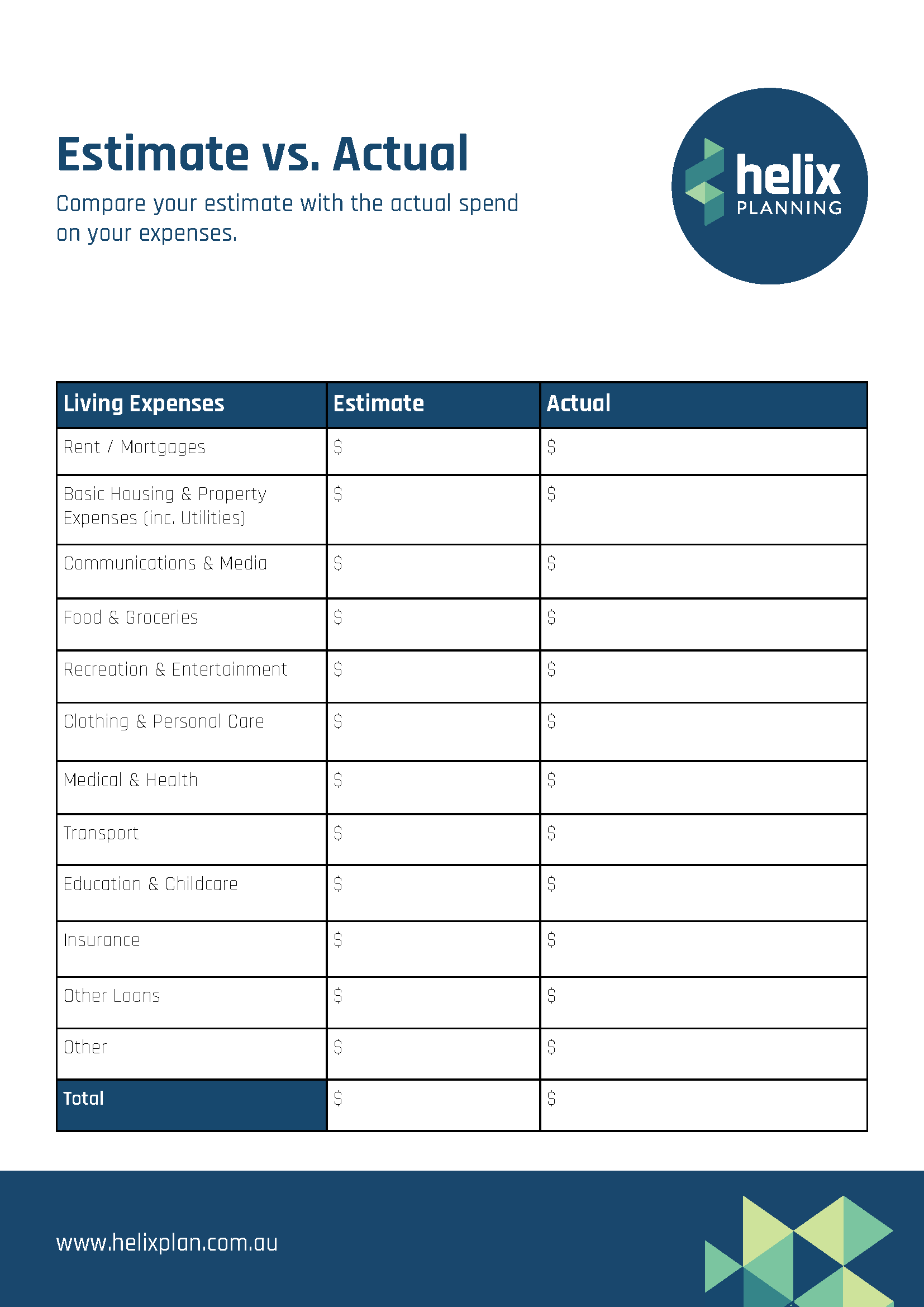

10-14 Downloadable activity worksheets to put your learning into practice and to help you develop strategies

Our worksheets are designed to help you understand the content and develop your very own budget and money goals!

8-11 Quizzes and surveys to test your knowledge and reflect on your progress

Put your learning to the test with quiz questions at the end of each module to reinforce what you have learnt!

Access to an exclusive Facebook community for extra support on your financial journey

Connects you with people who are just like you, sharing tips and tricks on how they are taking back control of their finances while keeping each other accountable well after the course is finished!

Lets Get Started!

Step 1

Fill in the relevant form below to receive your individual invoice

Step 2

Pay the invoice– upon receipt of payment you will be given a code and the ability to begin your course

Step 3

Begin your Streetwise Money™ journey

-

The Streetwise Money course is an online financial literacy program designed to help individuals learn how to budget, track, and achieve their financial goals. It offers easy-to-follow video modules, downloadable activity worksheets, and quizzes to reinforce learning. The course is self-paced, allowing participants to complete it on their own schedule.

-

For NDIS participants aiming to take more control of their financial situation and achieve greater independence, the Streetwise Money course provides valuable skills in cash flow management, budgeting, and financial planning. These competencies align with the NDIS's goals of enhancing participants' capacity to manage their own funds effectively.

-

Yes, NDIS participants may be able to use their Capacity Building funding to cover the cost of the course. It's important to consult with your Plan or Finance Manager to ensure that the appropriate item codes are included in your NDIS plan before enrolling.

FAQS

-

The course includes modules on:

Cash Flow Management

Budgeting

Managing Financial Gaps

Tax Preparation and Understanding Profit & Loss Statements

These topics are designed to equip participants with practical skills to manage their finances confidently.

-

The Streetwise Money course is delivered through online video modules that you can complete at your own pace. Alongside the videos, there are downloadable worksheets and quizzes to help reinforce the material and apply the concepts to your personal financial situation.

-

Yes, participants gain access to an exclusive Facebook community where they can connect with others taking the course. This platform allows for sharing tips, asking questions, and receiving support throughout your financial journey.ion text goes here

-

To enroll, visit the official course page on Sarah Eifermann's website. Ensure that your NDIS plan includes the necessary Capacity Building item codes before registering. If you're uncertain, discuss this with your Plan or Finance Manager. Fill in the correct form to get the process started.

-

No prior financial knowledge is required. The course is designed to start with foundational concepts and progressively build your financial literacy, making it suitable for individuals at all levels.

-

Once enrolled, you will have ongoing access to the course materials for 12 months, allowing you to revisit the content and resources as needed to reinforce your learning.

About our course provider

Sarah Eifermann

Bachelor of International Relations, Dip. Fin.Serv.(Mort.Broking), Advanced Leadership Certificate (WLA), Strategic Leadership & Coaching (Harvard Business Extension School), Business Acumen Gauge Practitioner.

Sarah Eifermann is more than an award-winning finance broker, business strategist, and motivational speaker—she’s a transformative guide for business owners and leaders seeking clarity, sustainability, and growth. With over 20 years of experience and a deep understanding of the challenges faced by entrepreneurs and business leaders, Sarah crafts solutions that address not just surface-level problems but the root causes of inefficiency, burnout, and stagnation.

Her rare ability to uncover and solve deeper business challenges creates opportunities for life-changing outcomes. Sarah’s insight allows her to identify core issues that even the business owners or leaders themselves might not recognise. Working with Sarah isn’t just about fixing what’s broken; it’s about building and leading a business that thrives from the inside out, delivering clarity, confidence, and long-term success.

Sarah has been recognized among the top 150 brokers nationally by her aggregator, earning accolades such as the Commercial Rising Star award and the CABFA Women in Finance Scholarship. As a Mentor for the Startup Bootcamp Australia Global Accelerator Program and the President of her local regional Business Chamber, Sarah continues to champion innovation, resilience, and personal growth.

As the founder of Helix Planning, Sarah combines analytical expertise, intuitive understanding, and hands-on experience to empower business owners and leaders, especially technical specialists, to navigate the complexities of leadership and entrepreneurship. She specialises in financial clarity, strategic planning, and building sustainable businesses that support their owners' and key persons health and happiness.

For those ready to overcome overwhelm, rediscover purpose, and create a thriving business, Sarah’s guidance is the key to unlocking transformational results. Let her show you how to break through the chaos and build a business—and life—that truly works for you.

Only Self or Plan Managed Participants can use our services

As we are NOT a Registered NDIS Provider, only those Participants who are Self or Plan Managed can utilise our niche education offering. You must ensure you have the correct NDIA Codes in your Plan BEFORE you request an invoice from us. It is the responsibility of the NDIS participant, their plan nominee, or financial manager, and not Sarah Eifermann or SFE Enterprises Australia Pty Ltd to determine whether the Course is an eligible expense under their NDIS plan and funding category. The Course is not registered with the NDIS, and purchases must be made using self-managed or plan-managed funding. By purchasing the Course using NDIS funds, you confirm that you have assessed its relevance to your plan goals and that the expense complies with NDIS funding guidelines.